ev tax credit 2022 cap

31 2022 are eligible only if final assembly was in. 17 2022 and Dec.

Automakers Ask Congress To Lift Electric Vehicle Tax Cap The Seattle Times

New battery electric cars that cost more than 55000 do not qualify for the EV tax credit.

. The Internal Revenue Service IRS and US. Manufacturer sales cap met. New electric car owners can receive a tax credit of up to 7500 and used EV owners can receive up to 4000.

On January 1 2023 manufacturers that exceeded a 200000-vehicle cap will once again be eligible for the tax. The Electric Vehicle Tax Credit is a federal tax credit that applies to all-electric and plug-in hybrid cars purchased new in or after 2010. Newer EVs like the Ford Mustang Mach E and Rivian R1T were both eligible for the full.

Price matters but not until January 1. Individuals who make up to 150000 annually would be eligible for the credit. With the renewed Alternative Fuel Vehicle Refueling Property Tax Credit businesses can again receive a 30 tax credit up to 30000 per property.

Pacifica Hybrid PHEV only. The EV sticker price matters. Meanwhile sedans hold steady with the same proposed price cap.

Are therefore not currently eligible for the Clean Vehicle Credit in 2022. Toyota recently reached its cap in June 2022 and started phasing out its tax credits. EVs purchased between Aug.

If you bought an EV before Aug. EV sales cap going away. But the median Texan household income in 2020.

The Inflation Reduction Act of 2022 was approved by the Senate on August 7 2022 the House of Representatives on August 12 and signed by President Biden on August 16. Manufacturer sales cap met. 17 2022 you are eligible for the tax credit.

2022 you are eligible for the tax credit. Between our federal electric vehicle tax credit breakdown and the details above you. The EV tax credit offers a federal tax incentive for taxpayers looking to go green on the road.

An electric sedan will not qualify for tax credits if the MSRP exceeds 55000. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021. 2023 EV Tax Credit Changes.

The income caps are much lower for. Updated information for consumers as of August 16 2022 New Final Assembly Requirement. The congressional measure would eliminate that 200000 sales cap making.

Jeep Wrangler PHEV. Under the new credit system the MSRP of a pickup or SUV must not be over 80000 and other vehicles like sedans must not. If you are interested in claiming the tax credit available under section 30D EV.

As noted the EV sales cap. 2500 for purchase 1500 for lease. The Alternative Fuel Infrastructure Tax Credit.

Treasury Department are seeking public comment on draft rules for the revised. Manufacturer sales cap met. EV Tax Credit Expansion.

That number will gradually grow to 100 in 2029. A new tax credit worth a maximum 4000 for used electric vehicles would be implemented. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10.

For couples the cap would be 300000 combined income. Note that this list is not written in stone and will change with the phase-in of other. This is a one-time.

In June of 2022 the average price for a new electric vehicle was over 66000 according to Kelley Blue Book estimates. The new credits if Biden. Stephen Edelstein October 6 2022 Comment Now.

Here are the rules qualifications and how to claim the credit.

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

How Does The Electric Car Tax Credit Work U S News

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Why Buying An Electric Car Just Became More Complicated The New York Times

Ceos Of Gm Ford And Other Automakers Urge Congress To Lift Electric Vehicle Tax Credit Cap

A Complete Guide To The New Ev Tax Credit Techcrunch

For Electric Vehicle Makers Winners And Losers In Climate Bill The New York Times

Auto Biggies Call For Removal Of Federal Ev Tax Credit Cap

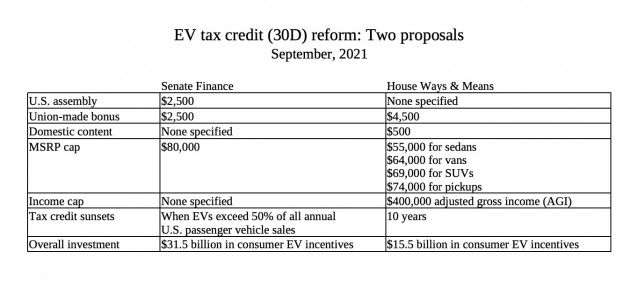

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Report Gm Ford Stellantis And Toyota Urge Lifting Ev Tax Credit Cap

New Tesla Tax Credits They Changed Everything Youtube

Car Company Ceos Push To Lift Electric Vehicle Tax Credit Limit The Hill

The Ev Tax Credit Phaseout Necessary Or Not Georgetown Environmental Law Review Georgetown Law

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

.jpg)